Paris, March 20, 2025 -In a context marked by the rise in rates, geopolitical uncertainties and increasing regulatory pressure, investors adopt a posture of increased selectivity with regard to tertiary real estate assets. These dynamics were at the heart of the exchanges of Real Estate Day 2025 , organized in Paris by Finance Innovation , in partnership with Swiss Life Asset Managers. The #Realestateday2025 revealed a heavy trend for tertiary real estate: the logic of marked selectivity . The intervention of Beatrice Guedj (Swiss Life Asset Managers, Head of Research, PHD) and that of Julien Congretel de Sienna, Investment Managers notably made it possible to objectify this strategic turn for investors. Present as an attentive witness to these changes , Sobre Energy was able to observe the expectations expressed by investors and confirm the relevance of its solutions, in particular through the Datamarc Neo , which supports the actors in the responsible and piloted valuation of their heritage.

1. Performances 2024: sectoral but also geographic differences

« Industry and hotel industry were yesterday the locomotives. Nothing indicates that they will still be tomorrow. »

In 2024:

- The offices recorded a loss of -27 % in capital.

- The industrial sector displays -19 % , and the residential -14 % .

- Only the hotels stands out with a slight rebound ( +2.2 % ).

📌 Note: French tertiary real estate has resisted better than its German counterpart, due to a more defensive market structure and a lower exposure to leverage. However, this advance could be temporary.

2. Rate and geopolitical: a new market situation for 2025

The rise in rates to 10 years since the beginning of 2025 (> 3.5 % in France and Germany) weighs heavily on the valuation of assets, in a context of Trump's return to the United States and hardening of overall financial conditions.

🔎 Perspective: the German recovery plan carried by the CDU-CSU coalition of Friedrich Merz provides for a structured and funded green revival. It opens up new investment prospects in the German market , especially for land or funds already exposed.

On the other hand, runoff on the French market will be limited, in the absence of equivalent budgetary measures.

3. Invest in 2025: return to fundamentals + environmental requirement

According to Julien Congretel of Sienna Investment Managers, investors refocus on:

- immediate rental yields ,

- a defensive valuation ,

- ingredients already aligned or aligned at controlled cost with environmental expectations.

- Financial return remains the basis as Ghislaine Seguin President of Spirit Entreprises also pointed out

- ESG criteria become a defensive exclusion filter, but insufficient if they are not translated into concrete and encrypted action plans.

🛠️ The approach becomes multidimensional: technical, legal, financial and operational.

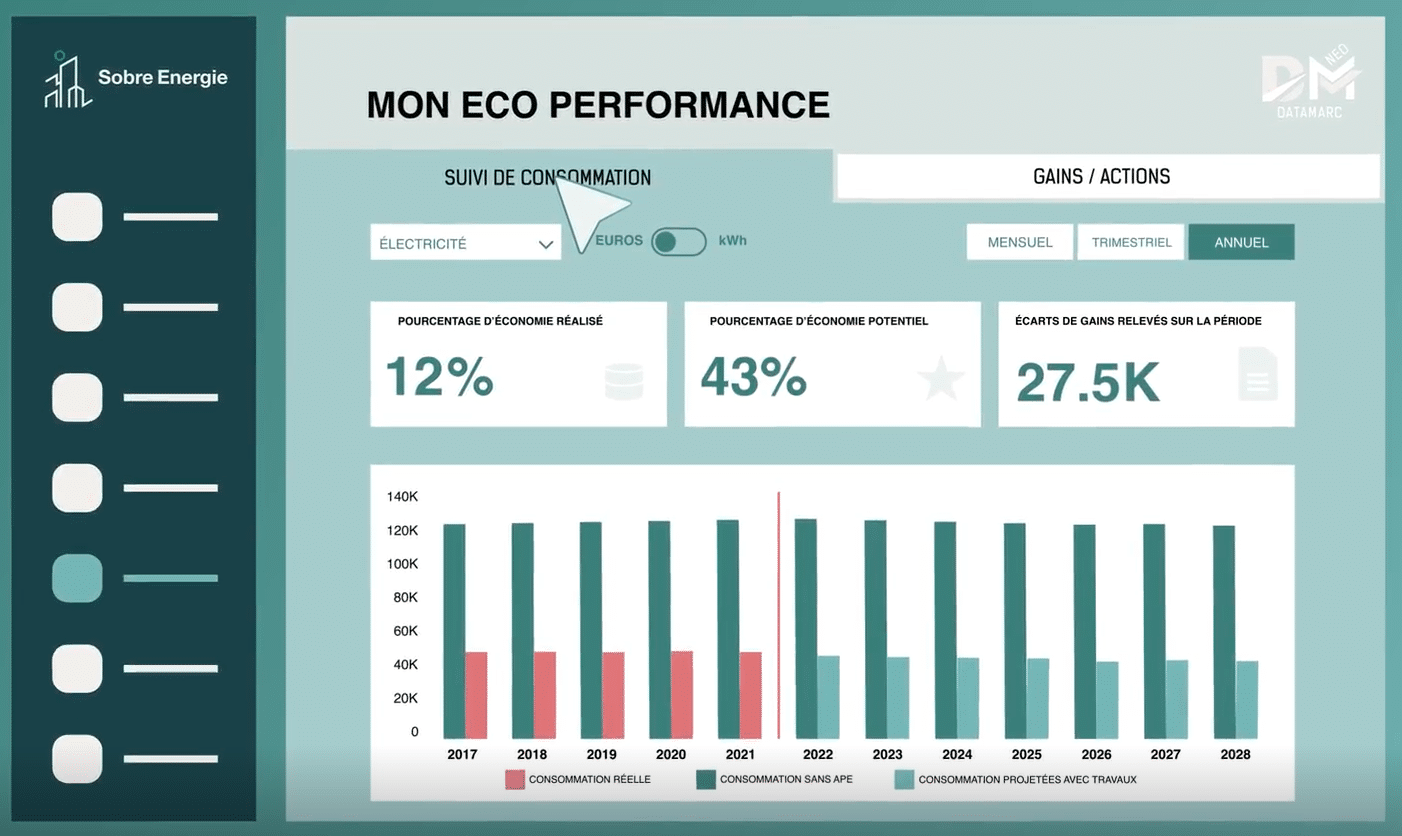

4. Supervision of assets: the example of “my eco-performance” in Datamarc Neo

- cross the analyzes of Energy Managers with the automated building of buildings ,

- Integrate contractual (CPE) or proactive ,

- Continuously measure the difference between target performance and real performance.

🎯 By combining business approach, legal engineering and financial modeling, my eco-performance allows:

- to secure the value of assets ,

- to make the upgrade effort visible,

- And above all to remain readable and attractive for investors .

Conclusion

Tertiary real estate is not in a global crisis, but in accelerated and strategic recomposition . The market now distinguishes assets capable of:

- generate solid flows ,

- Master their environmental trajectories,

- Integrate into new financing models.

In this context, only operational, measurable and controlled solutions such as those of Datamarc Neo and my eco-performance can guarantee that the assets remain in the radar of the investors of tomorrow.

A big thank you Finance innovation Swiss Life Asset Managers Maximilien Nayaradou Fabian Hürzeler for this superb 3rd edition of the #Realestateday2025, an essential forum for investors, #Proptech and the whole ecosystem in order to build future synergies and collaborations in the face of the issues of the new period that opens.