A horizon 2030, les collectivités françaises devront doubler leurs investissements pour répondre aux enjeux posés par la transition énergétique. Comment les financer ? Plus d’endettement ? Fiscalité en hausse ?

Décryptage de l’étude inédite de notre partenaire la Banque postale avec l’institut I4CE.

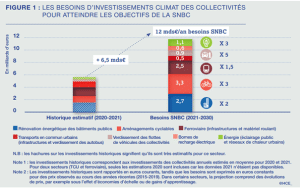

Le mur d’investissement climat

Accélération de la rénovation énergétique des bâtiments dans le cadre du Décret Tertiaire, renouvellement de l’éclairage public par du relamping, investissements promouvant des mobilités douces, autant de chantiers rendus nécessaires par l’urgence climatique. Mais très coûteux, plaçant les collectivités face à un « mur d’investissement »: celles-ci dépensent en moyenne aujourd’hui 6,5Md€/an, elles devront doubler leurs investissements d’ici 2030 pour respecter les objectifs de la Stratégie Nationale Bas Carbone (SNBC) de la France et atteindre la neutralité carbone à horizon 2050.

Comment établir votre stratégie Décret Tertiaire ? Télécharger notre livre blanc

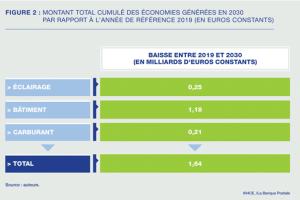

Des économies d’énergie réelles mais un TRI long

Des investissements conséquents, mais qui permettront de générer des économies d’énergie : au total, en euros constants de 2019, les économies en dépenses d’énergie réalisées par l’ensemble des collectivités territoriales atteindraient 1,64 Md€ en 2030, à rapprocher des 4,7 Md€ de dépenses énergétiques payées en 2019 (5,6 Md€ en 2022).

Mais avant d’effectuer des retours sur investissements, les collectivités doivent financer ces investissements. Quels sont leurs leviers d’action?

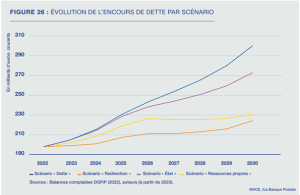

4 scénarios sont mis en avant dans l’étude, avec pour chacun un moyen de financement différent :

- Scénario « dette », tout le besoin de financement additionnel est alimenté par de l’emprunt

- Scénario « redirection », les investissements climat additionnels sont réalisés à la place à la place des investissements habituellement réalisés pour d’autres politiques publiques

- Scénario « Etat », augmentation du soutien de l’État par une indexation de la dotation globale de fonctionnement (DGF) sur l’inflation et par la pérennisation du « fonds vert » au-delà de 2024, à 2,5 Md€ par an sur la période, le reste du besoin de financement additionnel étant couvert par de l’endettement

- Scénario « ressources propres », augmentation des taux de fiscalité locale, augmentation des tarifs, niveau élevé de cessions d’actifs et prélèvement sur le fonds de roulement, le reste du besoin de financement additionnel étant couvert par de l’endettement.

Triple enseignement majeur

- Tous les types de collectivités (communes, départements, régions) voient leur niveau d’endettement augmenter fortement pendant la période

2. Le scénario « Etat » d’une contribution plus importante de l’Etat via la hausse de la dotation globale aux collectivités, associée à une pérennisation du Fonds vert à 2,5Md€ chaque année ne suffit pas à franchir le mur d’investissement.

3. Le scénario le plus soutenable pour les finances publiques est celui du recours à la fiscalité, mais c’est évidemment le plus délicat possible à mettre en œuvre. Il prévoit par exemple la hausse de la taxe foncière de +6 points en 2027.

CEE, prêts verts, programme Edurenov, en savoir plus sur les solutions de financement de nos partenaires pour vos bâtiments

🤖 Résumez cet article avec une IA

Cliquez sur un bouton pour résumer automatiquement cette page avec l’IA de votre choix.